MARKET RESEARCH

Ord Minnett Research

Deutsche Bank Research

a2 Milk and Synlait – Balancing risk vs. reward – SML result – balancing ATM growth vs. concentration risk

SML has reported a strong FY18 result with NPAT +95% to NZ$75(¥8,250)mn. The growth primarily driven from a further step change in finished infant formula from ATM (DBe 90% of IFC volume) along with a strong ingredients underpin. Looking fwd, SML issued an understandably muted IFC outlook, given its outstanding regulatory applications for other IFC brands. That said, the bottom end looks underpinned by our ATM volume forecast. On the earnings call, mgmt also noted higher cost-in (e.g. R&D) and a conditional acquisition of a specialty cheese manufacturer as it looks to balance capturing continued growth from ATM but also diversifying its concentration risk.

Battery Materials – Lithium Battery Supply Chain – update from Melbourne – The impact of pricing on the market, battery technology and ESS topical

We recently attended the Benchmark World Tour conferences in Melbourne. Presentations discussed the following topics: 1) The lithium price fall, causes and outlook, 2) Li-ion battery evolution, vanadium flow batteries and the energy storage market and, 3) Opportunities in the battery supply chain from a number of developing companies. Key points: 1) Outlook for li-ion batteries remains robust given gigafactory developments. 2) Lithium battery cell costs continue to fall and are now at $120(¥13,200)-130/kWh (industry consultant estimate) and, 3) Solid-state batteries are gaining an increasing R&D focus globally but appear to be 5+ years away from penetrating EV due to technical hurdles.

EDITORS PICK’s FOR LAST WEEK – USA

SS&C Technologies – Better Deal Synergies Ahead, Upgrade to Buy

Earlier this week, Ashish Sabadra upgraded shares of SS&C Technologies (SSNC, USD 57.66) to buy and also hosted the company’s CEO at our DB Tech Conference. SSNC shares have been under pressure recently around investor concerns that the company has moved too fast making 3 sizeable acquisitions this year. However, we like the recent deals (Intralinks being the most recent) as we believe SSNC is executing on its growth strategy, while buying these companies at attractive & accretive multiples. Earnings growth is expected to accelerate to 30% y/y in 2019 and 20% in 2020, driven by cost synergies and organic growth. Historically, the company has accelerated the pace of cost synergies and delivered above synergy guidance, which could provide upside to our forward numbers. After meeting with mgmt this week, we have even more confidence that the synergy targets are likely too low. All together, we have raised our estimates for the Eze and IL acquisitions (expected to close in 4Q18). Accordingly, we expect the street estimate for 2020 EPS to go up from $3.55(¥330) towards our estimate of ~$4(¥440). Our target price of $72(¥7,920) is based on 18x 2020 PE roughly in-line with the 5-year average forward PE and represents 13x 2020 EV/EBITDA. SSNC is currently trading at 13x 2020 PE and 10x 2020 EV/EBITDA, a significant discount to 5-year NTM PE and EV/EBITDA of 19.6x and 13.5x EV/EBITDA.

Discovery Communications – Catching the vMVPD Momentum

Amidst the challenging consumer video market with shrinking traditional video subscribers, we continue to see Discovery Communications (DISCA, USD 31.84) as a winner in the move to over-the-top (OTT) video and vMVPDs. This week Bryan Kraft raised his revenue, EBITDA, and FCF forecasts to reflect additional vMVPD distribution wins through Hulu and Sling TV, along with a DISH Network contract renewal. Improved vMVPD distribution was one of the reasons for our upgrade of Discovery back in April. The only major vMVPD provider that doesn’t carry Discovery content is YouTube TV. Despite the recent move in DISCA shares, we believe the stock still has significant upside given the attractive valuation (10% 2018 unlevered FCF yield), rapid deleveraging of the balance sheet (we estimate Discovery will reach the high end of its 3.0-3.5x leverage target by mid-2019), improved vMVPD carriage, and significant share repurchase capacity beginning in late 2019 (when we estimate Discovery will reach its leverage target). As a result, we are raising our 12-month PT to $40(¥4,400), which implies an 8.0% 2019E unlevered FCF yield and 25% upside.

Allergan – Doc Survey Show Big Opportunity in Wet-AMD

One of Allergan’s (AGN, USD 190.08) most important pipeline drugs is its anti-VEGF called abicipar for the treatment of wet-AMD (age-related macular degeneration). Although we think abicipar could add a conservative $500(¥55,000)mm in peak sales by 2020 (which is ~$11(¥1,210)/share of theoretical DCF value), the street appears lukewarm. To better understand the market opportunity for abicipar, Greg Gilbert conducted a survey of 30 ophthalmologists that treat wet-AMD. The key conclusions from the survey were that while the docs liked the fixed q12 week dosing of abicipar, they view ocular inflammation as a hurdle to prescribing in some instances. However, despite the inflammation issue, the docs still predicted significant share for abicipar within their wet-AMD patients, which we view as very encouraging. While we are not changing our model, the survey results reinforce our view that our abicipar estimates could prove conservative, particularly if AGN is able to reduce the rate of inflammation with its optimized formulation. The next key event that will help better define the potential for abicipar will be presentation of the full Phase 3 data at AAO (10/27-30). We continue to like the risk/reward in AGN. Buy, $210(¥23,100) price tgt.

Morgans Research

Overnight Highlights

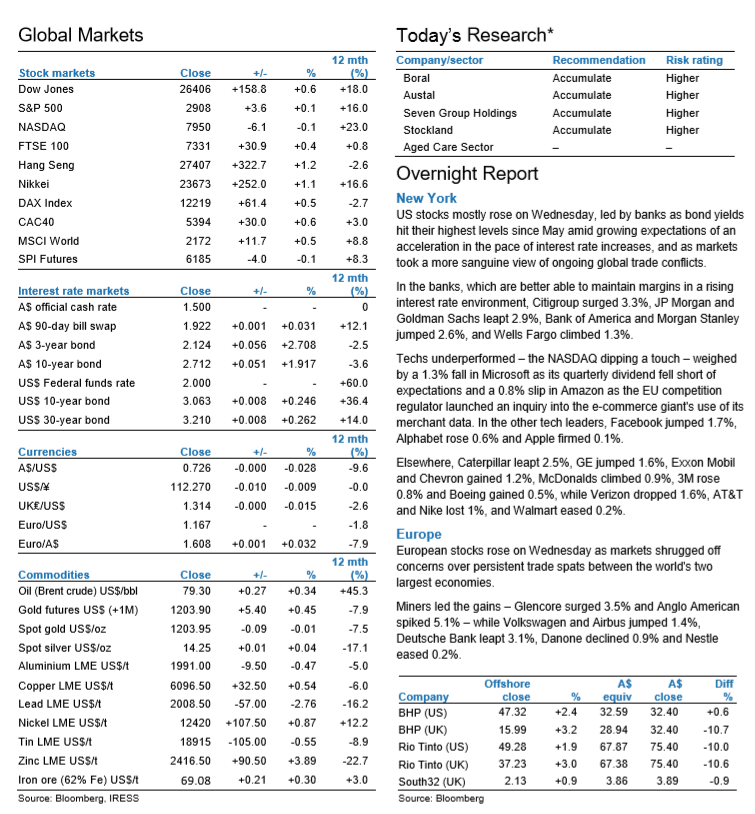

US Market: The S&P 500 and the Dow Jones Industrials Average rose on Wednesday, helped by upbeat housing data and a gain for bank stocks driven by rising Treasury yields, while the tech-heavy Nasdaq was weighed by a drop in Microsoft. European Market: A rally in European shares extended for a second day thanks to gains in trade-sensitive mining and autos stocks. Asian Market: Hong Kong shares rose to a two-week high, joining a broad rally in Asian markets, as investors saw limited impact from an escalating Sino-US trade war, and bet on more stimulus from Beijing to bolster growth.