Ord Minnett Research

Deutsche Bank Research

BHP – 15% (plus tax rebate) harvest

BHP – Ticker: BHP.AX, Closing Price: 33.11 AUD, Target Price: 36.00 AUD, Recommendation: Hold. We view BHP’s A$10.4(¥1,100)bn returns program as particularly friendly to Australian shareholders given the tax component on both legs. A 50/50 off-market buyback in Australia to commence immediately and then special dividend applicable to all shares on issue in January 2019 post the buyback, should most broadly satisfy holders. Within this note we have updated our model and NPV to reflect the announced proceedings.

ANZ – 2H18 result – in line at underlying level

ANZ – Ticker: ANZ.AX, Closing Price: 25.93 AUD, Target Price: 29.00 AUD, Recommendation: Hold. 2H18 cash NPAT better than forecast, in line at underlying levelANZ’s 2H18 cash NPAT of $2,994(¥329,340)m was ~2% above our forecast, though pre-provision profit was in line. The low BDD charge was the key driver of the beat at the bottom line. Operationally, the NIM was slightly weaker (-4bps hoh on normalised basis), but this was offset by a stronger OOI outcome. One of the key features of this result was the outperformance of the Institutional division whilst the Australia division underperformed, reflecting the headwinds facing domestic retail banking. Looking forward, continued cost control could provide upside if the group delivers on its goal to reduce its cost base. With ANZ trading at a 3% premium to its historical PE rel vs majors, HOLD maintained.

National Australia Bank – 2H18 result – cost outlook reiterated

National Australia Bank – Ticker: NAB.AX, Closing Price: 25.21 AUD, Target Price: 30.00 AUD, Recommendation: Buy. 2H18 cash NPAT was slightly below our forecasts, but some positives NAB’s 2H18 result was a slight miss against our expectations, with cash NPAT ~2% lower than our forecast. However we saw several positives in this result. While the margin decline of 3bps was slightly worse than we expected, the underlying margin decline was only 1bp, a decent outcome. The group also delivered cost growth within guidance, and reiterated a flat outlook for the next two years. The capital position was slightly ahead, with the CET1 trajectory looking a little more comfortable. Similar to ANZ, the result showed retail banking faces a tough environment, and NAB’s business franchise was a strength. Maintain Buy.

Woolworths – 1Q just a singultus. Well positioned for Christmas quarter

Woolworths – Ticker: WOW.AX, Closing Price: 28.43 AUD, Target Price: 31.00 AUD, Recommendation: Buy. Confirmation of improved sales post Little Shop & Plastic bags welcome news Our recent proprietary survey (refer FITT – 3rd Annual Battle for Baskets Survey – Woolworths hasn’t lost is mojo) left us comfortable that Woolworths will resume its sales outperformance. The better than expected 1Q result and confirmation of accelerating sales suggests the Group recovered from the July/August disruption even quicker than we thought and gives us even more confidence. Woolworths is well positioned to execute well over the key Christmas period and given it has largely stuck to its plan, it’s continuing to please its customers while Coles is distracted with its demerger. Buy retained.

Sonic Healthcare – Medicover 3Q18 – strong revenue growth in German pathology

Sonic Healthcare – Ticker: SHL.AX, Closing Price: 22.66 AUD, Target Price: 28.10 AUD, Recommendation: Buy. Diagnostic Services impacted by German reimbursement changes Medicover’s (MCOVB, not rated, SEK81.70) 3Q18 result revealed Diagnostic Services organic revenue growth was 13.5% and test volumes increased 7.8%. Management noted the German reimbursement changes that were introduced in 2Q18 continued to have an impact on reducing public referrals from doctors in this quarter. However the impact continued to be mitigated to a certain degree by higher volumes of privately paid and private insured referrals.

Aristocrat Leisure – IGT 3Q18 result positive for Aristocrat

Aristocrat Leisure – Ticker: ALL.AX, Closing Price: 27.21 AUD, Target Price: 41.45 AUD, Recommendation: Buy. DB view We view IGT’s 3Q18 as supportive of our thesis that the North American gaming market remains stable and that Aristocrat is continuing to gain market share. IGT’s North American Gaming & Interactive earnings declined by 33% on a 12% decline in revenue (5% underlying). Earnings were impacted by a strong comp, higher depreciation expense and jackpot timing. The Gaming Ops installed base increased by 6 units sequentially, however, yields declined by 2% while unit sales were up 7% with replacement sales up 4.5%. We retain our Buy rating on Aristocrat.

Crown Resorts – Trading update well below expectations

Crown Resorts – Ticker: CWN.AX, Closing Price: 12.26 AUD, Target Price: 12.30 AUD, Recommendation: Hold. Valuation reduced 7% to $12.30(¥1,320)/share; Hold rating maintained We view Crown’s trading update as weaker than expected as main gaming floor revenue was down 0.6%, which was well below our forecast for growth of 2.6%. This was down on a soft comp (+1%) and it lagged the improvement evident in the second half (+2.3%). Non-gaming revenue growth of 3.5% was slightly below our expectations of +3.9% while VIP turnover growth of 13% was slightly ahead of our forecast of +12%. Crown Melbourne was particularly disappointing with main gaming floor revenue flat on pcp and Crown Perth was down ~1.8%. We maintain our Hold rating with the stock trading in line with our valuation of $12.30(¥1,320)/shr and at 20.8x FY19e earnings (10.2x EBITDA).

Star Entertainment Group – Domestic trading update stronger than expected

Star Entertainment – Ticker: SGR.AX, Closing Price: 4.82 AUD, Target Price: 6.20 AUD, Recommendation: Buy. Buy rating and $6.20(¥660)/share valuation maintained We view Star Entertainment Group’s trading update to October 21 to be net positive for the company as domestic revenue growth of +6.7% was well above our forecast of +4.1%, notwithstanding that flat VIP turnover was below our forecast of +19%. The intermediate Sovereign Room has had a strong start with revenue growth above that of the property, and this is primarily volume driven. The domestic comps get easier, however, VIP becomes more challenging. We retain our Buy rating with the stock trading at a 22% discount to our valuation of $6.20(¥660)/share and at 16.2x FY19e earnings. Star is also trading at a 22% discount to Crown.

Lithium market – Is the tide turning on lithium?

Lithium prices show green shoots after EV sales lift in September. Our recent trip through China highlighted the potential for lithium carbonate pricing support into Q4 on i) a lift in auto sales into the end of the year, ii) a reduction in salt lake production in the Qinghai province and iii) reduced output by high cost lepidolite converters and marginal spodumene producers. Since Monday this week, we have seen two price increases: 1) in 99% lithium carbonate to RMB 70,000/t / USD$10,070(¥1,107,700)/t (Figure 3) and 2) in 99.5% lithium carbonate to RMB 80,000/t / US$11,509(¥1,265,990)/t (Figure 4). While the gains are encouraging we expect to see strong EV sales continuing to support lithium demand until the end of the year (for more details see latest Evision Plug 5, page 8). We have BUYS on Orocobre (PT A$6.50(¥660)/sh) and SQM (US$56(¥6,160)/sh).

Ausdrill Limited – Barminco acquisition

Ausdrill Limited – Ticker: ASL.AX, Closing Price: 1.55 AUD, Target Price: 2.00 AUD, Recommendation: Buy. BUY – $2.00(¥220) price target. Due to a change in team structure, we transfer coverage of ASL from Wassim Kisirwani to Ben Brownette with immediate effect. We analyse the Barminco merger and reflect on ASL’s FY18 result.

Rhipe – Ripe for the picking

Rhipe – Ticker: RHP.AX, Closing Price: 1.23 AUD, Target Price: 1.65 AUD, Recommendation: Buy. Leveraged to the cloud, with multiple growth channels – Buy We initiate coverage on RHP with a Buy rating with the stock trading at a 25% discount to our $1.65(¥110) DCF-based PT. Our Buy is predicated upon: (1) RHP’s leverage to accelerating growth in productivity SaaS and cloud adoption; (2) attractive capital-light and cash generative business model; (3) robust earnings growth (forecast 3 yr EPS CAGR 46%); & (4) strong relationship and alignment with the fastest growing cloud platform. Furthermore, RHP has a robust B/S with $23(¥2,530)m of net cash, and presents as an attractive M&A target for global IT distributors.

Morgans Research

Call to action – BHP Billiton Demonstrating genuine care for the interests of its diverse shareholder base, BHP will split the US$10.4(¥1,100)bn proceeds from the ‘shale sale’ between an off-market share buyback and special dividend. This falls in line with our estimate of a 50/50 special/buy-back, as a result no change to our estimates other than to the timing of the buy-back. The final day of eligibility for the buy-back is 5 November, while BHP will trade cum-special dividend until 9 January 2019. This comes on top of the high ordinary dividend we expect BHP to maintain in the short- to medium-term. A great outcome for investors, we maintain our Add recommendation.

Overnight Highlights

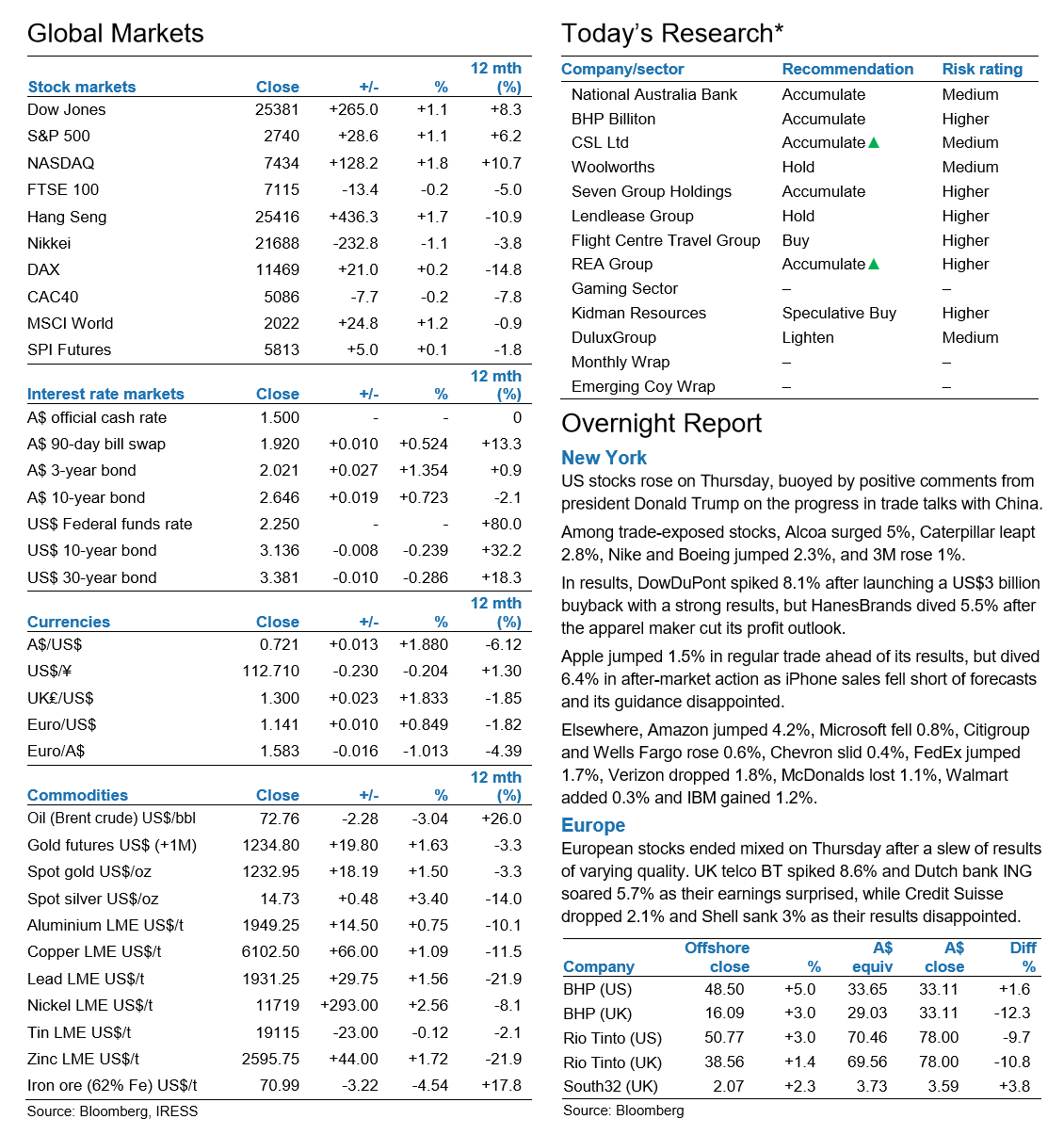

US Market: US stocks rose for a third straight day, as industrials gained after President Donald Trump said trade talks with China were “moving along nicely” and healthy results from chipmakers boosted optimism.

European Market: European shares hit a two-week high as strong results from Dutch bank ING and UK telecoms group BT helped offset a disappointing update from Credit Suisse, and ASM International brought some cheer to chipmakers.

Asian Market: The Hong Kong stock market gained grounds on the back of a stronger yuan and policy support for the Chinese economy. Real estate companies lead the advance, but pressure remains on the sector as financing costs rise.

Company Reports

National Aust. Bank (A$25.35(¥2,750)) ADD TP A$31.50(¥3,410) Comforting result NAB has reported. FY18 cash earnings of $5.702(¥550)bn, 0.7% better than our forecast. The composition of the result was broadly in line with our expectations. The final dividend is unchanged at 99cps fully franked, in line with our expectation. Good margin management at the group level is a commendable feature of the result and thus far such discipline has meant that NAB has not needed to increase its variable home loan rates in Australia unlike the other major banks. It is pleasing to see that the Company’s expense targets for the next couple of years are unchanged and the Company appears to be making good progress on its 3-year plan.

Corp Travel Limited (A$22.32(¥2,420)) HOLD TP A$23.30(¥2,530) Strong trading result overshadowed. We are satisfied with CTD’s response to the VGI report and concur that it appeared to contain a number of inaccuracies. Given the complexity of some of the claims, we expect CTD’s response will take time to be fully digested. The VGI report overshadowed a strong trading update by CTD and the potential growth opportunities that lie ahead over coming years. We continue to rate this company and its management team highly. However we maintain a Hold rating given cautious sentiment may outweigh fundamentals in the short term.

Orocobre Limited (A$3.72(¥330)) ADD TP A$5.68(¥550) Record profit margin. US$10,059(¥1,106,490)/t in Sep Q Production at Olaroz (ORE 66.5%) was 2,293t of lithium carbonate (LCE), after a planned (and announced) two-week maintenance shutdown and subsequent production ramp-up, and down from the 3,596t produced in the June 2018 quarter. The Olaroz JV reported revenue of US$32(¥3,520)m (US$44(¥4,840)m previously) for the quarter with the lower tonnage sold. The average received price was US$14,699(¥1,616,890)/t FOB (US$13,653(¥1,501,830)/t previously), a margin of US$10,059(¥1,106,490)/t (US$9,853(¥1,083,830)/t previously). We have modelled production for FY’18/19 to 15,000t of LCE, an average of 4,236t for each remaining quarter. We have factored in the Argentinian tax rate of 35% in perpetuity and assumed the increased export tax remains in perpetuity. Our valuation has decreased to A$5.68(¥550)ps (A$6.35(¥660) previously) and we have eliminated the 10% premium to valuation for our target price of A$5.68(¥550) (A$6.99(¥660) previously).

Woolworths Group Ltd (A$28.70(¥3,080)) HOLD TP A$27.64(¥2,970) Building momentum after a slow start. While WOW’s 1Q19 sales overall were slightly below our expectations, momentum going into Q2 looks solid, particularly in the core Australian Food business. LFL sales growth in the core Australian Food business rose 1.8%, which underperformed Coles at 5.1%. Big W was the key positive surprise (LFL sales +2.2%) and builds on some encouraging results over the past 12 months. We make minimal changes to earnings forecasts and maintain our Hold rating on a largely unchanged A$27.64(¥2,970) target price (from A$27.68(¥2,970)).

Smiles Inclusive (A$0.75(¥0)) ADD TP A$1.10(¥110) Slow start disappoints. SIL has released its 1Q19 cashflow report which was below our expectations, highlighting higher integration costs and a lower revenue from a few JVPs. Although disappointing, we view the events as largely one-off and expect SIL to address these issues at the upcoming AGM. In our modelling we have moderated our acquisition assumptions taking a more conservative stance resulting in a lower NPAT forecast by ~15% over the next three years. As a result our target price has been reduced to A$1.10(¥110). Add.

CommBank PERLS XI Capital Notes. Commonwealth Bank of Australia (CBA) is seeking to issue 7.5 million CommBank PERLS XI Capital Notes (CBAPH) at an issue price of $100.00(¥11,000) per security to raise $750 million(¥82,500,000,000) (with the ability to raise more or less). Ability to lock in an issue margin of [3.70 – 3.90]% for an extended period given the term of 5.5 years to the Security’s Call Date. Opportunity for CommBank PERLS VI (CBAPC) holders to re-invest on a priority basis the proceeds of the purchase of their securities into the new PERLS XI Capital Notes Offer. CommBank PERLS XI Capital Notes are Basel III compliant regulatory capital instruments and as such contain Capital and Non-Viability trigger conditions which may in certain circumstances see the value of the Notes fall or the Notes written off.